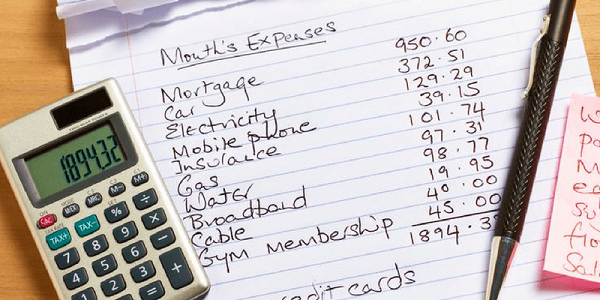

From time to time we all tend to lose control of our spending, money seems to go out as fast as it comes in and we don’t ever seem to be able to save up. It is getting harder to get ahead, pay rises are non-existent and everything else seems to cost more year on year. Phone bills, water, gas and electricity increase every year; how about council rates, car insurance, home insurance and health insurance, they seem to rise quicker than inflation itself and can make you feel defeated. Sometimes you need to re-evaluate the situation and take control of your budget; here is some helpful money advice to make it happen.

Work out what the necessities are.

There are certain expenses that make part of your budget that are necessary for you to survive. Rent or mortgage repayments, grocery budget, electricity, gas, water and rates are all expenses that are necessary. These essentials need to be a priority, so have them in order before including anything else in your weekly or monthly budget.

Beware the credit card trap.

Having a credit card is less of a requirement today and they can put your budget in the red without you knowing. It is so easy to charge everything through the card and deal with the one bill when it comes time to pay but even though you had it under control and wasn’t in debt, most people tend to dip into their savings when their card is due. Instead, try using a debit card so you know what is coming out of your bank account straight away.

Spend on what is important to you.

Working out what is important to you can provide some clarity on how you allocate your spending. If health and lifestyle is important, perhaps a higher food or sports budget is necessary and if gifts and entertainment isn’t a priority, then a smaller budget is adequate. Your budget should reflect your priorities and values.

Be conscious about your spending.

Once you have come up with a realistic figure for your budget that is achievable, work out how much you have to spend each day. By having a set amount to spend, you are more conscious about your spending. If you go over the set amount one day, try and stay under the next or if you have a big social gathering coming up on the weekend, try to keep costs minimal during the week.

Save your spare change.

Ever have annoying spare change in your pocket that you never seem to be able to buy anything with? Try saving all that spare change in a jar so you can track your progress, all your cents, one and two dollar coins and even five dollar notes. Over the course of the year, it’ll sure add up and provide for a great surprise come Christmas time.